Business Bulletin

IN THIS ISSUE

- Post-election 2013 – State of Play

- Income tax – changes

- Combatting “Dividend Washing”

- Adjustment notes for GST

- Payments of refunds of overpaid GST

- Do you run a second-hand goods business?

- Interaction between the otherwise deductible rule in FBT and the income tax law

- Letters to directors of companies with overdue superannuation guarantee obligations

- Information from the ATO about SMSFs

- ATO Publications

POST-ELECTION 2013 – STATE OF PLAY

The 2013 Federal Election was held on 7 September 2013 and following this, the Coalition has formed government. Below is a recap of the tax policies the Coalition announced prior to forming government that will change the tax landscape that was known prior to the election:

- Abolish the Mining Tax (minerals rent resource tax) – With this is to come the wind back of other measures that were intended to be funded by the mining tax, being:

- The increase to the instant asset write-off that took the amount to $6,500 for small businesses;

- The accelerated deprecation for motor vehicles that is available to small businesses;

- The loss carry-back measure which allows companies and entities taxed like companies to carry back up to $1 million in tax losses to offset against taxable income in an earlier income year;

- The Schoolkids’ Bonus which replaced the Education Tax Refund from 1 January 2013.

- Abolish the carbon tax.

- Cut the company tax rate by 1.5% to 28.5%.

- Impose a levy of 1.5% on companies with taxable income of $5 million or more to assist with funding the Coalition’s proposed Paid Parental Leave scheme.

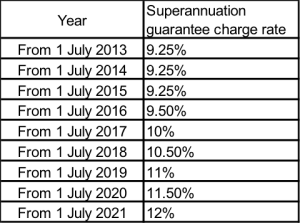

- Delay the increase in the superannuation guarantee charge percentage from 9% to 12% by 2 years.

- Undertake a tax reform white paper process.

It is worth noting that Parliament will resume on 12 November 2013 and will sit until 12 December 2013.

INCOME TAX – CHANGES

As indicated by the Coalition prior to the Federal election, the carbon tax and minerals resource rent tax are going to be repealed. The Government has since released exposure draft legislation repealing these measures from 1 July 2014. Other tax measures that were brought in at the same time are now to be wound back as detailed below:

- The instant asset write-off amount of $6,500 for small businesses – from 1 January 2014, the instant asset write-off will be reduced back to $1,000;

- The accelerated deprecation for motor vehicles that is available to small businesses – from 1 January 2014, this will no longer be available;

- The loss carry-back measure – this measure will only apply for the 2013 income year;

- The Schoolkids’ Bonus will no longer be available;

- The increase to the superannuation guarantee charge percentage will be deferred by 2 years so that it remains at 9.25% for the 2014, 2015 and 2016 income years. See the table below for the proposed rate increases over the coming year:

The Government will also not proceed with the following personal income tax cuts which were to commence on 1 July 2015:

- Further increase in the tax-free threshold from $18,200 to $19,400;

- Increase the income tax rate to 33% (from 32.5%) for the income bracket $37,001 – $80,000;

- Change to the low income superannuation contribution as it will no longer be available.

Note!

These changes are just contained in exposure draft legislation only and are subject to consultation. Therefore the details of the wind back of these measures may change or may not occur as they need to pass through Parliament first. You should ask your tax adviser about the progress of these measures if any of these proposed changes are likely to affect you.

COMBATTING – “DIVIDEND WASHING”

Prior to the Federal election, the former Assistant Treasurer announced a measure to combat “dividend washing”.

Dividend washing occurs when a person sells shares ex-dividend and the person selling the shares retains the right to the dividend and the franking credits. Then the same person immediately buys equivalent cum-dividend shares (which include the right to an additional dividend and franking credits). This can be done with listed shares where a special “cum-dividend” market is created for the shares for the two days after they go ex-dividend. This allows the same person to obtain the dividend and franking credits twice while only holding one set of shares.

The measure is intended to apply from 1 July 2013 to prevent investors who have been able to engage in this practice from claiming both sets of franking credits on the one parcel of shares. Per the former Assistant Treasurer’s press release on 28 June 2013, “The measure will not have an impact on typical ‘mum and dad’ investors, as it will only apply to investors that have franking credit tax offset entitlements in excess of $5000.”

To assist taxpayers to understand what is proposed, the ATO has put some details about this measure on its website.

Note that this measure has not yet been brought into the tax law.

Note!

If you think that this measure may impact you, speak to your tax adviser about it to find out the progress of this measure.

ADJUSTMENT NOTES FOR GST

If you have a business where you issue adjustment notes, you should take note of the following:

- Waiver of adjustment note requirement instruments made

A couple of legislative instruments have been made that affect when the requirements for holding an adjustment note can be waived:

- The requirement for an entity to hold an adjustment note can be waived in certain circumstances before attributing a decreasing adjustment to a tax period when the entity holds a document that meets the information requirements prescribed in the relevant legislative instrument;

- The requirement for an entity to hold an adjustment note can be waived in certain circumstances before attributing a decreasing adjustment (arising from a certain adjustment event in respect of an acquisition relating to a reimbursement) to a tax period when the entity holds a document that meets the information requirements prescribed in the relevant legislative instrument.

- GST Adjustment note information requirements

A legislative instrument was made to amend the existing legislative instrument that details the information required to be included on an adjustment note.

- ATO ruling on Adjustment Notes – GSTR 2013/2

The ATO has revised the ruling that it has issued in relation to adjustment notes.

In particular, the Ruling outlines:

- when a document is in the approved form for an adjustment note;

- the information requirements that the Commissioner has determined under the relevant provision of the GST Act and an explanation of how those information requirements in the relevant legislative instrument (mentioned in (ii) above) apply; and

- when the Commissioner will treat a particular document as an adjustment note even though that document does not meet all of the adjustment note requirements under the GST Act.

PAYMENT OF REFUNDS OF OVERPAID GST

Previous editions of TaxWise have noted the Government’s plans to clarify the operation of a provision in the tax legislation that inhibits a taxpayer from getting a refund of GST already paid to the Commissioner if it turns out the GST was overpaid because a supply was incorrectly treated as a taxable supply.

The Bill that contains this change lapsed as a result of Parliament being prorogued due to the Federal election.

Note!

As Parliament will be resuming in November and December, it is possible that this proposed legislative change could be reintroduced into Parliament later this year.

DO YOU RUN A SECOND-HANDGOODS BUSINESS?

The ATO has issued a determination in relation to second-hand goods acquired for the purpose of sale in the ordinary course of business, GSTD 2013/2.

The Determination provides how the GST Act will apply where second-hand goods are acquired by a business. It notes that:

- Second-hand goods are acquired for the purpose of sale in the ordinary course of business under the relevant provisions of the GST Act where an entity that acquires second-hand goods is in the business of buying and selling second-hand goods, and the goods are acquired for the purpose of being sold in the ordinary course of that business.

- Second-hand goods are not acquired for the purpose of sale in the ordinary course of business under the relevant provisions of the GST Act where the goods are acquired only in order to be leased, or where there is simply an intention that the goods will ultimately be sold after they are no longer required (except in the circumstances noted in the Determination).

To do!

If you acquire second-hand goods as part of your business, see your tax agent to see if you are correctly accounting for them for GST purposes.

INTERACTION BETWEEN THE OTHERWISE DEDUCTIBLE RULE IN FBT AND THE INCOME TAX LAW

The ATO recently released Taxation Ruling TR 2013/6 which sets out the Commissioner’s views on whether a ‘once-only deduction’ arises in calculating the taxable value of an ‘external expense payment fringe benefit’. This concerns a deduction from the expenditure associated with that fringe benefit and whether that expenditure would be subject to the loss deferral rules affecting losses from non-commercial business activities under the income tax law.

An associated Taxation Determination TD 2013/20 was released at the same time concerning this type of expenditure and salary sacrifice arrangements. Your tax agent will be able to assist you to determine whether there are any implications for you in relation to expenditure incurred associated with providing expense payment fringe benefits.

LETTERS TO DIRECTORS OF COMPANIES WITH OVERDUE SUPERANNUATION GUARANTEE OBLIGATIONS

During October 2013, the ATO issued letters to directors of companies that have unpaid superannuation guarantee amounts. The letter explains the director’s obligations and personal risk in relation to their company’s superannuation guarantee debt.

It encourages directors to ensure their company addresses the outstanding superannuation guarantee debt either by paying it immediately or by establishing an agreed payment plan.

The letter follows changes that were made on 1 July 2012 to the tax and superannuation laws to reduce the scope for companies avoiding superannuation guarantee liabilities.

To do!

If you are a director of a company and you have received one of these letters, speak to your tax agent about what you should do.

If you are a director of a company and you have not received one of these letters, now may be a good time to check to make sure your company is meeting its superannuation guarantee obligations anyway.

INFORMATION FROM THE ATO ABOUT SMSFS

If you have a self-managed superannuation fund (SMSF), take note of the following pieces of information the ATO has recently issued about SMSFs:

- Starting and stopping a pension: The ATO has released an SMSF News Alert. The News Alert summarises the contents of recently released Taxation Ruling TR 2013/5, entitled "Income Tax: when a superannuation income stream commences and ceases".

- The ATO has published or updated the following documents about SMSFs:

- Disqualified persons and self-managed super funds;

- Thinking about self-managed super;

- Changes to appointing an approved SMSF auditor.

- The ATO has also published new SMSF supervisory levy information and tables(SMSF supervisory levy – 2013 to 2016 financial years)

ATO PUBLICATIONS

Getting the company loss carry-back tax offset right

Though the loss carry-back measure is likely to be repealed (as noted above), it is available for the 2013 income year (year ended 30 June 2013).

As such, the ATO has noted that it has received a number of 2013 Company tax returns where the loss carry-back tax offset has been claimed incorrectly. This has caused delays in processing 2013 Company tax returns.

The loss carry-back tax offset, for the financial year in which carry-back tax losses are claimed, must be the lowest of:

- the loss carry-back tax offset component for the 2011-12 financial year;

- the maximum $1,000,000 losses multiplied by the corporate tax rate for the year you make a claim (that is, $300,000 in the 2012-13 financial year as the corporate tax rate of 30%), or

- the franking account balance at the end of the financial year in which the claim is made.

To prevent further delays in processing, some changes have been made to the electronic lodgment service (ELS).

To do!

Talk to your tax agent to see if you are eligible to carry back losses.

BUSINESS COMMUNICATOR – OCTOBER 2013

The ATO has published its October 2013 Business Communicator which has news and updates for businesses with an annual turnover between $2 million and $250 million.

ATO’S BACK TO BUSINESS BULLETIN – QUARTER 1 2013-14

The ATO has published its latest “Back to business” bulletin, a quarterly newsletter that provides information to help taxpayers understand their tax obligations and handy tips to complete their business activity statement. A copy of this bulletin can be accessed on the ATO website.

SMALL BUSINESS BENCHMARKS

The ATO advises that its small business benchmarks have been updated with data from the 2010-11 financial year. More information about benchmarks can be found on the ATO website.

PAYG INSTALMENTS – GDP ADJUSTMENT FOR 2013-14

Each year, the ATO adjusts PAYG instalment amounts using a formula that takes into account expected growth in the economy. This is known as the "gross domestic product (GDP) adjustment" and is based on data published by the Australian Bureau of Statistics.

For your information, the GDP adjustment the ATO will use to work out a taxpayer’s PAYG instalment amounts for the 2013-14 income year is 3%.

ARE YOU AFFECTED BY THE NSW BUSHFIRES?

The ATO has advised tax practitioners that if they or their clients are located in one of the bush fire affected postcodes identified on the ATO website, the ATO will automatically make arrangements to defer taxation obligations.

To do!

If you have been affected by the NSW bushfires, speak to your tax agent about arrangements you may be able to make with the ATO in relation to your tax obligations.